Introduction

In an era marked by rapid technological advancement, the global financial landscape has undergone a dramatic transformation, particularly through the rise of mobile payment solutions. Nowhere is this transformation more profound and promising than in developing markets. These regions, often characterized by limited access to traditional banking infrastructure, have become fertile ground for innovations in mobile finance. Emerging economies represent a significant portion of the world’s unbanked population, providing unique opportunities for startups looking to create low-cost mobile payment platforms. This comprehensive exploration delves into the innovation potential, the market disruption, and the strategic pathways critical for achieving success in this dynamic sector.

Innovation Potential in Mobile Payment Solutions

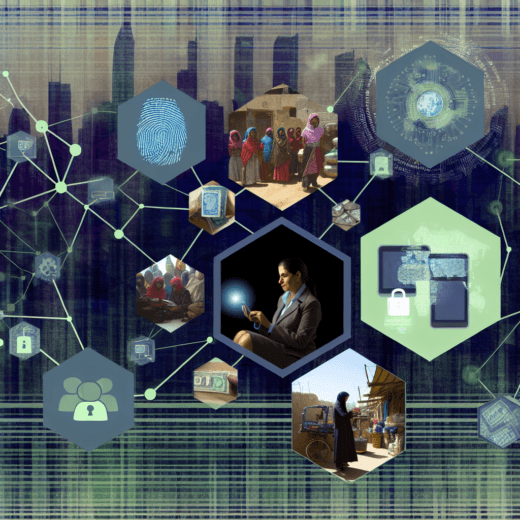

Developing markets present an unparalleled opportunity for innovation in mobile payment solutions. With a significant portion of the population lacking access to traditional banking, mobile fintech offers a direct route to financial inclusion. The penetration of smartphones, even in low-income regions, facilitates the creation of solutions that can be both affordable and impactful. Entrepreneurs are leveraging mobile technology to bypass the need for physical banking infrastructure, thereby reaching rural and underserved areas. Startups such as M-Pesa in Kenya have demonstrated how a simple text-based money transfer service can transform a nation’s financial habits, providing an inspirational case study of innovation meeting necessity.

In these markets, mobile payment solutions enable not only person-to-person transactions but also empower micro-entrepreneurs and small businesses. The introduction of m-commerce platforms allows artisans and farmers in remote areas to access broader markets, often for the first time. By leveraging this technology, developing regions can unlock dormant economic potential. Additionally, biometric authentication and blockchain technology are being explored to enhance security, offering avenues for further innovation.

Market Disruption and Emerging Economies

The adoption of mobile payments in developing markets is more than a trend—it is a disruptive force that challenges traditional banking paradigms. Unlike developed economies where banks have long been entrenched institutions, many people in emerging markets have never had a bank account. This gap in financial service provisions creates room for mobile platforms to reshape how transactions are conducted. Mobile payment solutions can offer lower transaction fees, higher efficiency, and greater convenience compared to traditional banks, disrupting the longstanding barriers to financial accessibility.

Startups tapping into these markets can capitalize on the flexible regulatory environments often found in developing countries. Governments, keen to promote financial inclusion, may offer incentives or regulatory support for mobile financial services. For instance, the rapid expansion of payment platforms in India was, in part, spurred by government initiatives like the Digital India campaign, which emphasized the importance of cashless transactions.

Moreover, market disruption is not limited to altering banking habits. By embedding financial transactions into social platforms and communication tools, startups can integrate themselves into the daily life of users, fostering habitual usage and dependency. This integration can lead to the establishment of superapps, which combine multiple services within a single platform, as seen with WeChat in China, offering compelling potential for similar models in other developing regions.

Key Challenges for Startups Exploring These Markets

Despite the exciting potential, startups in the mobile payment space face significant challenges in developing markets. Infrastructure limitations, such as inconsistent internet connectivity and limited smartphone penetration, can hinder the adoption of mobile solutions. To counter this, startups must design products that are both data-light and accessible on basic mobile devices. Furthermore, varying levels of financial literacy necessitate not only innovative technology but also consumer education and trust-building efforts.

Regulatory hurdles also pose a significant challenge. While some governments are supportive, unstable political environments or inconsistent regulation can introduce risks. Startups must navigate complex regulatory landscapes, requiring deep local knowledge and the ability to adapt to rapid policy changes.

A lack of financial infrastructure also implies a lack of data. Without historical financial data, it can be challenging for startups to underwrite loans or credit risk effectively, a hurdle for those exploring credit-based services. Additionally, securing reliable partnerships with local telecommunications providers and banks is often essential yet fraught with potential for logistical and bureaucratic challenges.

Unique Opportunities in the Startup Space

Amidst these challenges, unique opportunities abound for startups. The most successful ventures are those that tailor their solutions to local needs and conditions, recognizing the diversity across markets. Each region within the developing world presents different challenges and opportunities—what works in Southeast Asia may not be directly applicable in Sub-Saharan Africa.

Collaborations and partnerships with local entities can offer critical inroads. By working alongside local businesses, community organizations, and governments, startups can gain valuable insights and support. Additionally, international partnerships can bring technological expertise and investment, providing the edge needed to succeed.

There is also a significant opportunity to leapfrog older technologies and directly implement cutting-edge innovations. With no legacy systems to supplant, developing markets can be prime testing grounds for new fintech solutions. This lack of entrenched systems allows for rapid adoption of novel technologies, such as blockchain for secure transactions or artificial intelligence to enhance customer personalization and service efficiency.

Critical Strategies for Fundraising and Scaling

For startups, the ability to secure funding is crucial given the potentially high costs of scaling in diverse and sprawling markets. Engaging with impact investors, who are particularly interested in the social benefits of financial inclusion, can be a strategic advantage. These investors are not only keen on financial returns but also on the positive societal impact, aligning well with the mission of fintech solutions in developing regions.

Crowdfunding offers another pathway, especially for consumer-facing innovations. Raising capital through the collective investment of the everyday person, particularly when marketed as empowering underrepresented communities, can build both financial support and community buy-in. Additionally, partnership with established international corporations eager to invest in emerging markets can offer financial support, credibility, and technical expertise.

Once funding is secured, strategic scaling is essential. Piloting solutions in specific regions before a broader rollout allows startups to refine their offerings based on local reception and user feedback. Building scalable platforms is critical—technological infrastructure must support growth across different regions without requiring fundamental alterations to the system. This scalability is often achieved through cloud-based solutions, which provide flexibility and reduce overhead costs.

Achieving Product-Market Fit and Customer Acquisition

The product-market fit is the holy grail for startups in developing regions, where unique consumer needs require tailored solutions. Startups must engage deeply with prospective users, conducting extensive market research and leveraging local insights to mold their offerings. It is essential to understand cultural nuances and consumer behavior, often necessitating an on-the-ground presence.

Customer acquisition in developing markets can differ vastly from that in developed countries. Here, it often requires grassroots marketing efforts, education campaigns, and community engagement. Startups must build trust within communities, often through partnerships with trusted local entities or influencers. Additionally, leveraging social proof and testimonials can be powerful in regions where word-of-mouth remains a dominant form of communication.

Pricing models must be thoughtfully designed, keeping affordability and value at the forefront. Offering freemium models or tiered services can attract users while strategically moving them towards paid services. Additionally, loyalty programs and incentives can help maintain user engagement and foster a dedicated customer base.

Distinguishing Business Models and Technologies

Successful startups distinguish themselves through unique business models and advanced technologies. The choice between a direct-to-consumer model or a business-to-business approach can drastically influence a startup’s strategy. Some startups might focus on integrating with existing retail systems, while others aim at enabling peer-to-peer transactions, each with distinct market implications.

From a technological perspective, the integration of artificial intelligence can revolutionize customer interactions, offering personalized recommendations and automated support. Blockchain technology offers another avenue, particularly appealing for ensuring secure and transparent transactions, vital in regions where trust can be a barrier to adoption.

Moreover, developing a user-friendly platform is critical. The interface must be intuitive and accessible to individuals with limited technical proficiency. Language options and simplified user experiences help bridge educational and technological divides, enhancing user adoption.

Real-World Case Studies and Successful Startups

Examining successful ventures provides valuable insights and inspiration. M-Pesa, a cornerstone example, revolutionized money transfers in Kenya, demonstrating the power of simplicity in design and utility. Its success lay in understanding local needs and utilizing the prevalent mobile infrastructure, serving as a blueprint for similar initiatives in other countries.

Another notable example is bKash in Bangladesh, which leveraged partnerships with telecommunications companies and local banks to extend its reach. By fostering trust through strategic alliances, bKash overcame barriers to adoption, quickly becoming one of the largest mobile financial services in the country.

In Southeast Asia, GCash has emerged as a leading fintech solution by integrating financial transactions into everyday activities through their mobile wallet. Its success was driven by embedding itself into daily commerce and gradually expanding services, highlighting the potential of horizontal scaling.

These case studies reveal shared traits among successful startups: a keen understanding of local markets, strong partnerships, and a commitment to iteration based on user feedback.

Academic Research and Industry Reports

Numerous studies emphasize the transformative potential of mobile payment solutions in promoting financial inclusion. For example, research from the World Bank underscores the impact of mobile payments on poverty alleviation, citing examples where access to financial services has directly improved quality of life. Similarly, reports by McKinsey illustrate how digital financial services can boost GDP growth by increasing financial liquidity and economic participation.

Industry reports often highlight the rapid growth of the mobile payment sector in emerging markets, outlining key trends such as the increasing collaboration between fintech companies and traditional banks. These collaborations are central to overcoming infrastructure barriers and fostering mutual growth. Additionally, reports like those from the GSMA offer insights into mobile distribution trends, providing startups with vital data to inform distribution and user acquisition strategies.

Conclusion

As mobile payment solutions evolve, their potential to redefine financial systems in developing markets becomes undeniable. Startups willing to navigate the complexities and challenges of these regions with innovative, user-centric solutions can unlock vast opportunities, leading both economic growth and social transformation. While barriers exist, the path to financial inclusion is a rewarding journey, with mobile payment solutions playing a crucial role in shaping the future of emerging economies. By strategically leveraging technology, building strong local partnerships, and maintaining a keen focus on customer needs, startups can ensure their success in this burgeoning sector.