Introduction: The Rising Significance of Agriculture Insurance for Smallholder Farmers

In the world of agriculture, smallholder farmers stand as the unsung heroes, contributing significantly to global food security. Yet, they operate under extreme uncertainty, with crop failures remaining an ever-looming threat. The advent of agriculture insurance tailored specifically for these small farms is a beacon of hope, offering a financial shield against the adverse impacts of crop loss. This blog delves into the pivotal role of agriculture insurance, the innovation landscape within this domain, and strategies for startups aspiring to make an impact. We will explore real-world solutions, challenges, and case studies that highlight the transformative potential of insurance for smallholder farmers.

The Problem Landscape: Crop Failures and Their Impact

Smallholder farmers are particularly vulnerable to a myriad of risks ranging from adverse weather conditions and pests to price fluctuations and changing climate patterns. These farmers, who often lack the financial resilience of larger agricultural enterprises, face dire consequences when crops fail. Without insurance, a single season of poor yields could spell financial ruin, perpetuating the cycle of poverty and food insecurity. Therefore, there is a pressing need for accessible and tailored insurance solutions that can mitigate these risks and empower farmers to invest in their future without fear.

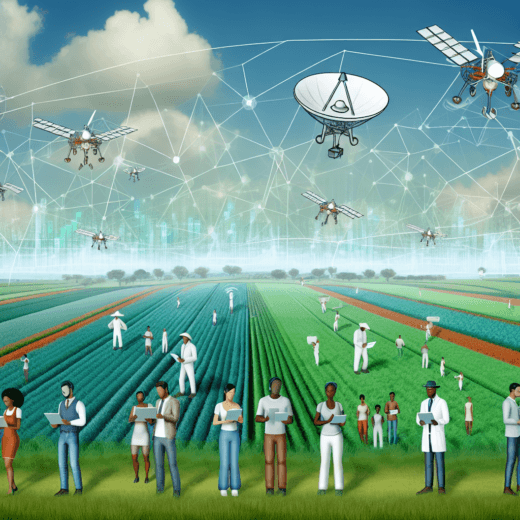

Innovative Potential in Agriculture Insurance

Innovation in agriculture insurance for small farms can take many forms, from leveraging technology for better risk assessment to creating affordable and flexible insurance products. With advancements in data analytics, remote sensing, and machine learning, companies can now offer more accurate and timely assessments of farm conditions and potential risks. For instance, satellite imagery combined with on-ground data can predict drought conditions or pest outbreaks, allowing for proactive interventions. This technological integration not only optimizes the insurance product but also enhances trust among farmers, encouraging broader adoption.

Market Disruption: Reimagining Traditional Insurance Models

The traditional insurance model, often seen as cumbersome and inaccessible, is ripe for disruption. Startups in this space are exploring unique models that challenge the status quo. Parametric insurance is one such model where payouts are made based on predefined events, such as rainfall levels dropping below a certain threshold, rather than a manual claims process. This not only speeds up the compensation process but also reduces administrative costs. Additionally, leveraging mobile technology enables wider reach and simpler user interfaces, critical for penetrating rural markets where digital literacy may be limited.

Key Challenges: Navigating the Roadblocks

Despite the promise, several challenges remain in the realm of agriculture insurance for smallholder farmers. Chief among these is the issue of trust. Farmers may be skeptical of new solutions, especially if they’ve been let down by traditional models in the past. Education and effective communication are crucial in bridging this gap, ensuring farmers are well-informed about the benefits and functionalities of the insurance products. Additionally, regulatory hurdles can be significant, varying greatly between regions and potentially hampering cross-border scalability of solutions.

Unique Opportunities: Tapping into the Underserved Market

The opportunity for startups lies in the vast, underserved market of smallholder farmers who lack access to customized insurance products. By addressing this gap, companies can not only drive financial inclusion but also contribute to broader societal goals such as food security and poverty alleviation. Collaborating with local governments, NGOs, and farmer cooperatives can amplify reach and impact, further embedding these solutions within the agricultural communities they aim to serve.

Strategies for Success

-

Fundraising: Building a successful startup in this space often requires robust funding strategies. Entrepreneurs should consider targeting impact investors who are aligned with social good and financial returns. VCs focused on AgTech and InsurTech present another viable source of capital. Tailoring pitch decks to highlight the dual impact—economic and social—of these ventures can significantly enhance appeal.

-

Scaling: Scaling in agricultural insurance requires an agile approach, focusing on regional customization while maintaining core functionalities. Leveraging technology to create scalable platforms that can adapt to diverse geographical and climatic needs is crucial. Partnerships with telecom and tech providers can facilitate this scaling by offering connectivity and tech support.

-

Achieving Product-Market Fit: Understanding the nuanced needs of farmers is paramount. This requires rigorous market research and iterative product testing. Creating pilot programs with local farmer groups provides valuable feedback, ensuring that the insurance products are not only fit for the purpose but also user-friendly. Localization, in terms of language and cultural norms, enhances acceptance and uptake.

-

Customer Acquisition: Reaching and retaining customers requires a multifaceted strategy. Grassroots marketing, leveraging rural influencers, and collaborating with agricultural extension services can enhance awareness and trust. Post-sales support and transparent communication channels further cement customer loyalty, crucial for long-term success.

-

Business Model and Technology: A unique business model can set a startup apart. Options such as freemium models, pay-per-use, or tiered pricing can cater to different financial capabilities. Employing technology not only optimizes back-end operations but also empowers farmers through value-added services like weather forecasts and farming tips, integrated within the insurance platform.

Real-World Case Studies

To illustrate the points, let’s explore successful startups that have made significant strides in agriculture insurance for small farms:

-

Pula Advisors: This Kenya-based startup has redefined agricultural insurance with a focus on bundling insurance with input financing and advisory services. By targeting the entire value chain, they have improved both reach and impact, serving over 4.7 million farmers across multiple African countries.

-

Weather Risk Management Services (WRMS): An Indian firm that provides weather-indexed insurance solutions alongside precision farming tools. Their integrated approach has not only safeguarded farmer incomes but also improved productivity.

-

Kilimo Salama: A micro-insurance innovation by the Syngenta Foundation offers small-scale farmers in Africa weather insurance accessible via mobile phones, which automatically triggers payouts when weather stations record adverse conditions. The system exemplifies how combining technology with insurance can enhance farmer resilience.

Academic Insights and Industry Reports

Academic research underscores the role of agriculture insurance in poverty reduction and climate adaptation. Studies highlight how insurance, coupled with improved seeds and farming practices, can double incomes and resilience for smallholder farmers. Industry reports, such as those from the Food and Agriculture Organization (FAO) and the World Bank, emphasize the importance of public-private partnerships in driving insurance uptake in rural areas.

Conclusion: Charting a Path Forward

Agriculture insurance for smallholder farmers is not just a business opportunity; it is a catalyst for socio-economic transformation. The startup ecosystem is uniquely positioned to unlock this potential through innovative solutions, strategic partnerships, and an unwavering focus on farmer needs. As entrepreneurs and investors continue to explore this field, they will undoubtedly find an abundance of possibilities to make a meaningful impact, heralding a new era of resilience in agriculture. The journey is challenging, yet the rewards—both financial and social—are profoundly compelling.